Purchase profile

What we're Seeking

Over the past few years, the Silberlake Real Estate Group has significantly expanded its portfolio of residential and commercial properties.

To continue growing, we are continually investing in multi-family homes, residential complexes, subsidized housing, value-add properties, light industrial properties, commercial properties for demolition and redevelopment, as well as building plots.

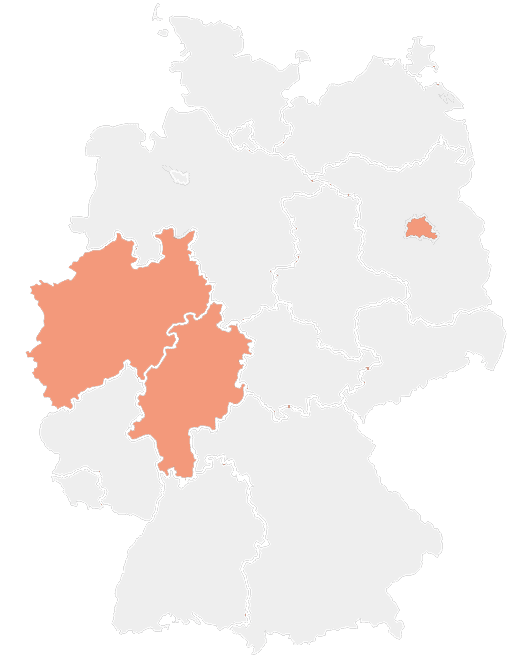

Our focus is on investment volumes ranging from 500,000 to 25 million euros in Düsseldorf and other cities in North Rhine-Westphalia.

Our business partners value us as a company that places great emphasis on a trusting collaboration and is capable of swift transactions due to its strong equity base.

Below, you will find our purchase profile, and we welcome you to contact us.

Types of Use

- Multi-family homes and residential complexes

- Subsidized housing

- Building plots

- Commercial properties for demolition and redevelopment (Düsseldorf)

- Light industrial

- Volumes from 500K – 25 million

Condition

- From 50 residential units in the portfolio

- Unrenovated properties from 4 residential units

- Projects with vacancy, investment backlog, rental potential

- Properties with public subsidies

- Unimproved plots of land

Location

- Düsseldorf and cities in North Rhine-Westphalia

- Medium to good locations

- Good transportation links and local amenities

Single properties, portfolios, and residential complexes: 1 million – 100 million.

- Asset Deal

- Share Deal

- North Rhine-Westphalia: Maximum of 20 times at market rents

- Düsseldorf and Cologne: Maximum of 25 times at market rents

- Value-add properties are assessed separately

- Renovated properties from 10 residential units

- Unrenovated properties from 4 residential units

- Properties with maintenance backlog

- Properties with value appreciation potential (vacancy, maintenance backlog, and rent increases)

- Properties with 100% vacancy

- Value-Add, Opportunistic Portfolios from 50 residential units per location

- Properties with public subsidies